While most of UAE residents are aware that VAT is coming from January 2018, but until now there has been little detail on what VAT would and would not apply to. So lets check what is VAT means and how does it affect the residents.

What is VAT?

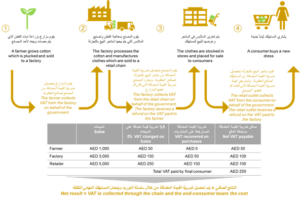

VAT (Value Added TAX), which is also called as ‘tax on consumption’, is simply a tax that is payable while purchasing any product. VAT is a particular percentage of the cost of goods and services, which is added by the producer to the inputs before they are sold as new offerings. The implementation of VAT is an important step to strengthen the indirect tax structure of any country.

Why VAT in UAE?

The implementation of VAT will be another source of raising revenues for governments in the Gulf Cooperation Council (GCC). GCC countries have decided to implement taxation as part of the governments’ efforts to diversify revenues in the context of sharp decline in oil prices.

Who will pay the VAT?

VAT will be payable by every individual in the country, who will be willing to buy any product or service.

What will be the VAT Rates?

The VAT rates will be equal or less than to 5% in UAE.

Is there will be VAT on Salary?

No, The UAE will remain tax-free in many ways even after the implementation of VAT as there is no income tax on salaries in the country.

What will be taxed?

Electronics, smart phones, cars, jewelry, watches, eating out, carbonated drinks, energy drinks and entertainment will fall under the taxed category.

All food set to be taxed under VAT in UAE

UAE’s VAT on gold jewellery will be on the entire piece

What will be exempt from the tax?

Education, healthcare, residential real estate, local transport and international travel are exempted from tax.

No VAT will be payable on nursery school, pre-school, elementary school and government-funded university fees as these will be zero-rated. Preventative and basic healthcare services and related goods and services will not attract a VAT charge. Certain financial services will be exempt from VAT, such as loans, mortgages and life insurance products, and Islamic banking will be treated in the same way as standard banking. Although VAT will be added to the price of petrol, the supply of local passenger transport, such as taxis, buses and the metro will be either exempt or zero-rated, and consumers will not be affected. International transport, whether by air, sea or road, will also be free of VAT.